Top 10 Wealth Management Companies

Last updated on: January 23, 2025

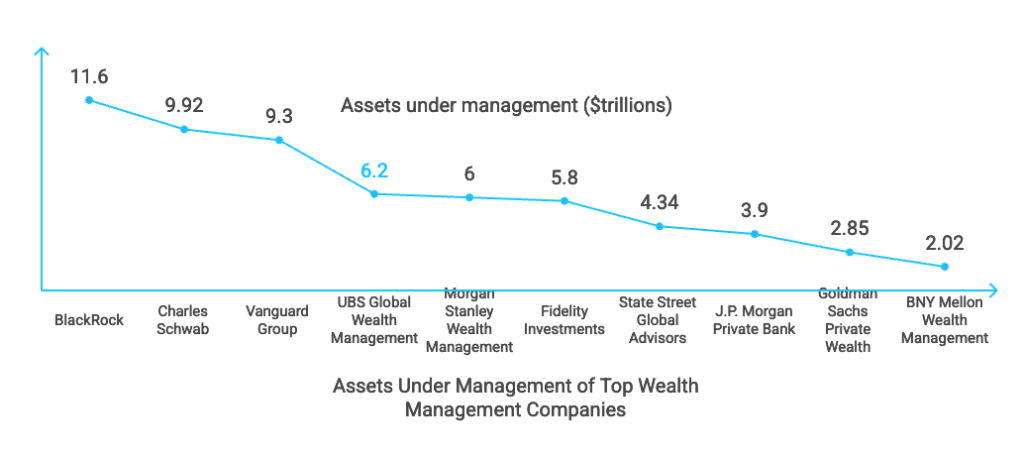

In 2025, the wealth management industry is led by firms that excel in innovation, client-centric strategies, and financial expertise. Below is a list of the top 10 wealth management companies, showcasing key metrics such as Assets Under Management (AUM), number of employees, and revenue.

| Rank | Company Name | AUM (USD) | Number of Employees | Revenue (USD) |

|---|---|---|---|---|

| 1 | BlackRock | $11.6 trillion | Not publicly disclosed | $20 billion |

| 2 | Charles Schwab | $9.92 trillion | 35,300 | $5.2 billion (Q4 2024) |

| 3 | Vanguard Group | $9.3 trillion | 17,600 | Not publicly disclosed |

| 4 | UBS Global Wealth Management | $6.2 trillion | 11,000+ | Not publicly disclosed |

| 5 | Morgan Stanley Wealth Management | $6 trillion | 16,000+ | $19.1 billion |

| 6 | Fidelity Investments | $5.8 trillion | 50,000+ | Not publicly disclosed |

| 7 | State Street Global Advisors | $4.34 trillion | 2,500 | Not publicly disclosed |

| 8 | J.P. Morgan Private Bank | $3.9 trillion | Not publicly disclosed | Not publicly disclosed |

| 9 | Goldman Sachs Private Wealth | $2.85 trillion | Not publicly disclosed | Not publicly disclosed |

| 10 | BNY Mellon Wealth Management | $2.02 trillion | 48,500 | Not publicly disclosed |

1. BlackRock

- AUM: Approximately $11.6 trillion

- Revenue: Surpassed $20 billion in 2024

- Overview: BlackRock is the world’s largest asset manager, offering products like iShares ETFs and the Aladdin platform for risk management.

- Source: Financial Times

2. Charles Schwab

- AUM: Approximately $9.92 trillion

- Number of Employees: Approximately 35,300

- Revenue: $5.2 billion in Q4 2024

- Overview: Schwab is a leader in tech-driven solutions and investor education, offering comprehensive wealth management services.

- Source: Barron’s

3. Vanguard Group

- AUM: Approximately $9.3 trillion

- Number of Employees: Approximately 17,600

- Overview: Vanguard is renowned for its low-cost funds and ETFs, emphasizing investor education and long-term strategies.

- Source: Investing in the Web

4. UBS Global Wealth Management

- AUM: Approximately $6.2 trillion

- Number of Employees: Over 11,000 financial advisors

- Overview: UBS is the largest wealth management provider globally, offering tailored advice and investment services to high-net-worth individuals worldwide.

- Source: Investing in the Web

5. Morgan Stanley Wealth Management

- AUM: Approximately $6 trillion

- Number of Employees: Over 16,000 financial advisors

- Overview: Morgan Stanley provides comprehensive financial services, including investment management and wealth planning, catering to clients globally.

- Source: Adv Ratings

6. Fidelity Investments

- AUM: Approximately $5.8 trillion

- Number of Employees: Over 50,000

- Overview: Fidelity provides a wide range of financial services, including brokerage, retirement planning, and wealth management.

- Source: Investing in the Web

7. State Street Global Advisors

- AUM: Approximately $4.34 trillion

- Number of Employees: Approximately 2,500

- Overview: State Street serves institutional clients with expertise in asset servicing and global market insights.

- Source: Adv Ratings

8. J.P. Morgan Private Bank

- AUM: Approximately $3.9 trillion

- Overview: J.P. Morgan focuses on ultra-high-net-worth individuals, offering estate planning and investment solutions.

- Source: Investing in the Web

9. Goldman Sachs Private Wealth Management

- AUM: Approximately $2.85 trillion

- Overview: Goldman Sachs provides bespoke wealth management solutions, focusing on alternative investments and global markets.

- Source: Adv Ratings

10. BNY Mellon Wealth Management

- AUM: Approximately $2.02 trillion

- Number of Employees: Approximately 48,500

- Overview: BNY Mellon delivers global investment management and estate planning services.

- Source: Adv Ratings

These firms exemplify resilience and adaptability, maintaining their leadership through innovative strategies and exceptional client service.

Want to email employees at these companies?

Use our Chrome Extension to find the email address from any LinkedIn profile